- Home »

- Inform »

- Markets »

- Market outlook »

- Euro should continue to appreciate

to read

Currencies

Euro/Dollar

Euro should continue to appreciate

|

|

|

<h2>Alternative assets</h2>

<h3>Gold</h3>

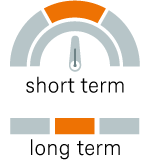

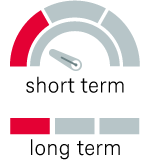

<p><b>Short-term under pressure due to speculations on rates, medium-term looks promising</b></p>

<table border="0" class="table-1 table-full-width">

<tbody>

<tr>

<td>

<p><img alt="orange green - en (3).png" src="/EPiServer/CMS/Content/globalassets/en-gb/_-graphics/graphics-che/orange-green-en-3.png,,93612?epieditmode=False&v=126376118" width="150" height="160" /></p>

</td>

<td>

<ul>

<li>The gold price has come under some pressure recently, particularly due to the excellent U.S. labor market data, fuelling expectations that the Fed might remain on its hiking path for longer than previously expected.</li>

<li>The trend towards a weaker dollar should, however, support the gold price. Additional support should come from the permanently high demand of gold from the central banks of emerging market countries.</li>

</ul>

<p>*Forecasts are based on assumptions, estimates, views and hypothetical models or analyses which may prove to be incorrect. Past performance is not indicative of future results. Source: DWS Investment GmbH, as of 10 July 2023</p>

</td>

</tr>

</tbody>

</table>

LegendThe strategic view by July 2024 The indicators signal whether DWS expects the asset class in question to develop upwards, sideways or downwards. They indicate both the short-term and the long-term expected earnings potential for investors. Source: DWS Investment GmbH; CIO Office, as of 10 July 2023 |

|

|

|

|

|

|

|