- Home »

- Inform »

- Markets »

- Market outlook »

- Interesting return opportunities with short-dated bonds

to read

“We are currently rather optimistic with a view to European sovereign bonds with short to medium maturity,” Oliver Eichmann, head of Investment Strategy Bonds, says. In Europe, we expect two further rate hiking steps by the ECB. This should mark the end of this hiking cycle for the time being. Combined with slowing growth and waning inflation, this should, in his view, be a good time to consider fixed-income assets. Eichmann adds: “In such a context, yields on short bonds tend to fall so that chances of price gains have the potential to rise correspondingly.” This will be particularly the case if the market is dominated by the view that a rate hiking cycle of the central bank is drawing to a close pretty soon. Due to higher yield levels, bonds from Italy and Spain continue to be interesting. “We do not, however, expect any further narrowing of spreads versus Bunds,” Eichmann states. Higher rate levels and falling asset purchases tend to be a burden on countries.

Food and services pushing up prices Components of inflation rates in the European Union In percent chart 2 en-gb Source: DWS Investment GmbH, as of July 2023

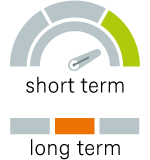

U.S. government bonds (10 years)

Only slightly higher yields expected

|

|

|

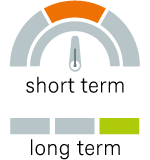

German government bonds (10 years)

Further rising yields should depress total returns

|

|

|

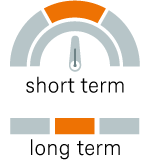

Emerging market sovereign bonds

Modest total returns expected

|

|

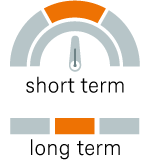

Credit

|

Investment Grade

|

High Yield

|

LegendThe strategic view by July 2024 The indicators signal whether DWS expects the asset class in question to develop upwards, sideways or downwards. They indicate both the short-term and the long-term expected earnings potential for investors. Source: DWS Investment GmbH; CIO Office, as of 10 July 2023 |

|

|

|

|

|

|

|