- Home »

- Inform »

- Markets »

- Market outlook »

- Opportunities with European bank stocks

to read

Europe remains our preferred investmentregion. The valuation discount versus U.S.stocks continues to be high. Particularly with a view to small- to mid-caps, current valuations appear to be cheap. The current price level should be a good entry point.“In our view, European banks appear to be also promising although they have already performed well in the last few months,” portfolio manager Jarrid Klug states. We expect European banks to revise earnings upward, contrary to their U.S. counterparts. “Their returns on equity should be slightly above ten percent for the time being, thus clearly beating the average of the past years,” Klug adds.

Markets still doubt banks’ ability to maintain their profits this high. This is reflected in cheap valuations. Based on earnings expected for 2024, the price to earnings ratio is currently six and thus extremely low. Even if interest rates were falling medium-term, there are no signs of European banks being in danger of troubles similar to those during the long lasting zero-rate phase. And another argument sounds very convincing: banks repaying capital via dividends and equity buybacks. The average dividend yield of the banking sector is meanwhile hovering around eight percent. Additionally, banks have started to repurchase stocks – with regulatory approval – so that the aggregate pay-out yield of some financial institutions is well above ten percent.

Valuation advantage for Europe

Price/earnings ratios based on profits expected in 2024

Source: DWS Investment GmbH, as of July 2023

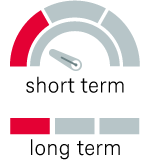

U.S. equities

Difficult environment: low earnings growth and very high valuations

|

|

|

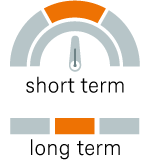

German Equities

German economy with signs of slowing – moderate price potential

|

|

|

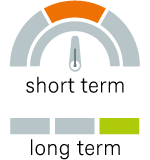

Equities Europe

Good prospects for European equities unchanged

|

|

Equities Emerging Markets

Sluggish recovery in China – double-digit earnings growth expected in the medium term

|

|

LegendThe strategic view by July 2024 The indicators signal whether DWS expects the asset class in question to develop upwards, sideways or downwards. They indicate both the short-term and the long-term expected earnings potential for investors. Source: DWS Investment GmbH; CIO Office, as of 10 July 2023 |

|

|

|

|

|

|

|