Every beginning is easy – with the right companion by your side

When was the last time we started something completely new? It can be exciting and challenging at the same time, for example learning a foreign language, playing a new instrument or getting your motorbike licence. At first it feels like having all thumbs. But with practice and support from an expert, it gets much better straight away.

Becoming an investor can be easy

Before getting started, you should clarify some basic questions. A click on the respective preference shows the result of all answers in the survey.

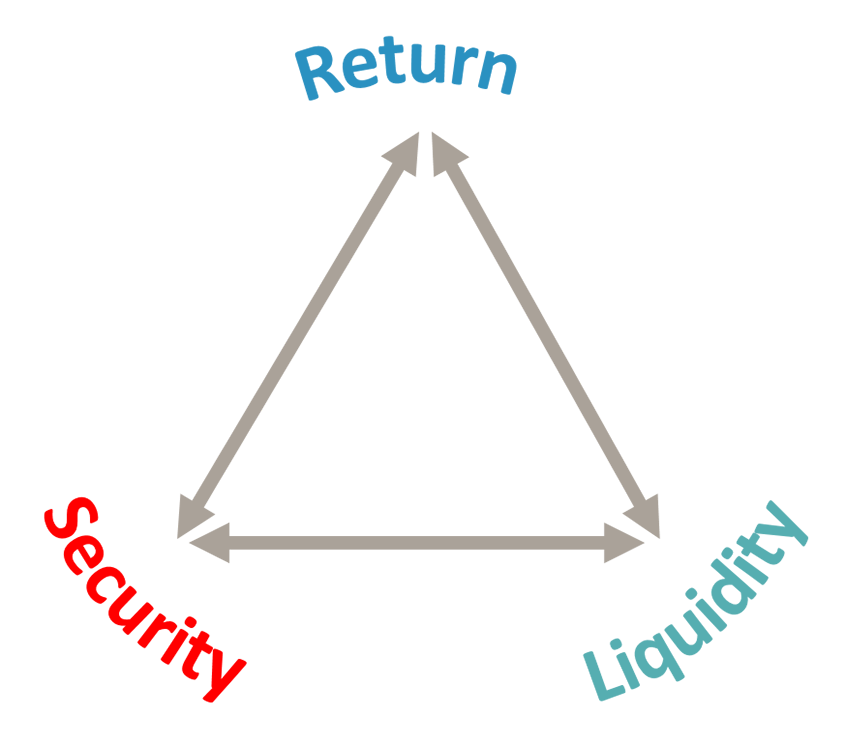

How long should the money be invested?

Which investment goals do you want to achieve?

How high is the willingness to take risks?

After preferences have been clarified, we go into details

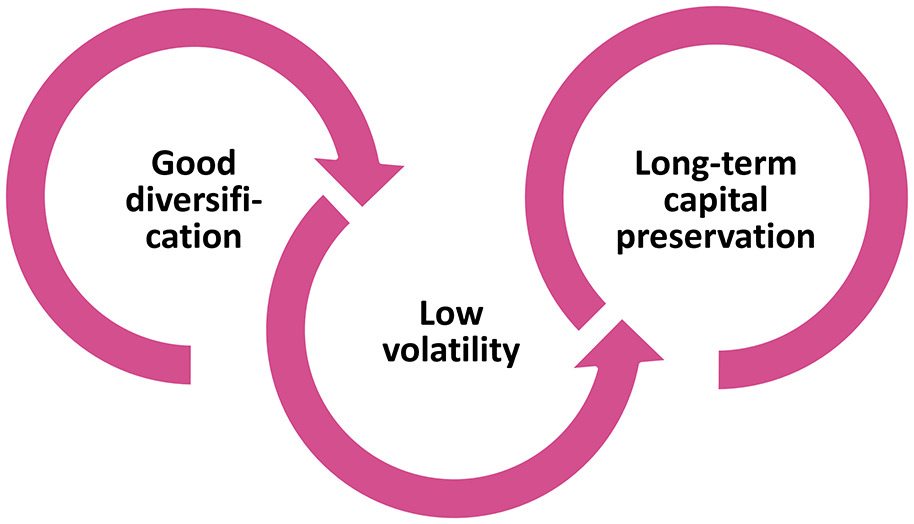

Recognizing earnings opportunities and keeping an eye on risks

The four components of DWS Invest Conservative Opportunities

** Corporate bonds enable industrial companies to raise debt capital on the capital market without requiring a banking license.

|

For investors who want to invest in the securities markets and who attach particular importance to solid and long-term capital preservation. |

Fund details of DWS Invest Conservative Opportunities LD

|

Shareclass[4] |

LD |

|

Currency |

EUR |

|

ISIN |

LU2034326236 |

|

Valor |

49761403 |

|

Issue premium[5] |

3,0% |

|

Verwaltungsvergütung |

0,950% p.a. |

|

Ongoing charges[6] plus performance-related fee from securities lending income |

1,140% |

|

Earnings |

Distribution |

Risks[7]

-

Market-, industry, and company-related exchange rate fluctuations.

-

Exchange rate fluctuations.

-

The unit value may fall below the purchase price at which the client acquired the unit.

-

Due to its composition/the techniques used by the fund management, the investment fund exhibits increased volatility, i.e. the unit prices may be subject to greater downward or upward fluctuations even within short periods of time.

-

The Fund invests a substantial portion in other funds. When investing in other funds, it must be considered that several target funds may pursue identical or opposing investment strategies. This may result in an accumulation of existing risks, and any opportunities for returns may cancel each other out.

-

The fund enters into a significant number of derivative transactions with various counterparties. A derivative is a financial instrument whose value depends on the performance of one or more underlying assets. Due to its design (e.g. due to a leverage effect), it can influence the Fund more strongly than is the case with the direct acquisition of the underlying assets.

- Price losses due to yield increases in the bond markets: If interest rates and/or yields in the bond market rise, newly issued bonds will have a higher interest rate than those already in circulation. Consequently, the price of the bonds in circulation will fall. When selling such bonds prior to their maturity, price losses may therefore arise.

- Issuer credit and default risk. This is generally understood to mean the risk of over-indebtedness or insolvency, i.e. the possible temporary or permanent inability to meet interest and/or repayment obligations on time.

More topics

1. No assurance can be given that the objectives of the investment policy can be achieved.

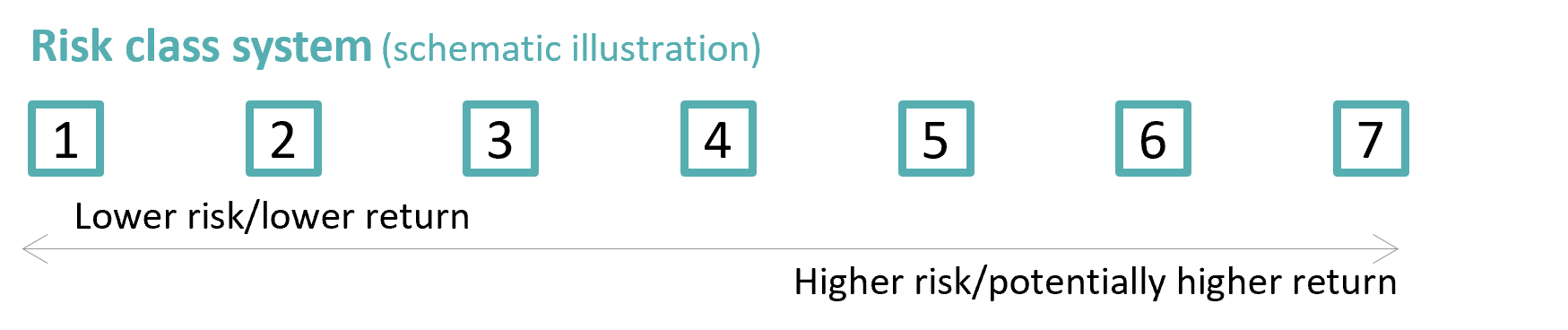

2. Risk class (RC) indicates the expected risk of loss based on historical data. This risk indicator is subject to change; RC 1: 0% - 0.5%; RC 2: 0.5% - 2%; RC 2% - 5%; RC 4: 5% - 10%; RC 5: 10% - 15%; RC 6: 15% - 25%; RC 7: 25%; There can be no assurance that the investment objectives will be achieved.

3. Forecasts are based on assumptions, estimates, opinions and hypothetical models or analyses that may prove to be inaccurate or incorrect. Past performance, simulated or actually realized, is not a reliable indicator of future performance. The calculation is based on annual periods of 1 to 30 years based on the monthly closing prices of the MSCI World*. Reference period: 31.12.1969 to 31.07.2024.

4. This document only contains information on the LD unit class. Information on any other existing unit classes can be found in the currently valid full or simplified sales prospectus.

5. In relation to the gross investment amount: 3.00% in relation to the gross investment amount corresponds to around 5.26% in relation to the net investment amount.

6. The ongoing charges disclosed here are an estimate of charges as the fund or share classes were only launched on 17 January 2022. Actual costs will only be calculated and disclosed after the first financial year. The annual report of the respective financial year contains details of the precisely calculated costs.