- DWS makes it easier for companies to be responsible

- DWS filtering system guarantees a sustainable selection

- Active ESG fund management eases investors’ workload

Most ESG funds in Germany are actively managed

Let others do it for you

If you want to be green, you have to take the pain. This is what a lot of investors think is true of building a sustainable portfolio. After all, endless hours of research and analysis lie in store for them as they do their due diligence: Does this company really take the environment into consideration? Does it act responsibly towards its employees? Does it invest in questionable businesses? There are so many questions around ESG criteria (environment, social and governance) that must be answered before you can buy a share or a bond.

Active fund management saves investors work

For investors who can’t (or simply won’t) do this work, there is a solution: investing in an ESG fund can save considerable time and effort. Actively managed funds (funds in which a specialist fund manager decides which securities are bought) are especially popular among ESG investors. Of the 433 sustainability funds in Germany, more than 90 percent are actively managed products, according to the rating agency Scope Analysis.[1]

Fund managers examine sustainability

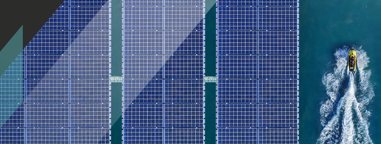

When selecting sustainable securities, fund managers look very closely at whether firms take certain ESG criteria into account. DWS has developed a filtering engine (the ‘ESG Engine’) to facilitate the process of compiling portfolios that are as sustainable as possible. Every company must pass a number of tests before it can become part of a sustainable fund.

Similar to the process of panning for gold, the software first sifts out the coarse stones: companies that have a questionable environmental and social track record, have a large CO² footprint, manufacture weapons, or make a large part of their turnover from tobacco or nuclear power, for example. DWS obtains the necessary data from the world's leading sustainability data providers, including Oekom and Sustainalytics.

433 total number of ESG funds in Germany

397 number of which are actively managed funds

Short process for ESG latecomers

Companies that remain ‘in the pan’ after the exclusion procedure are assessed by DWS according to a best-in-class approach: analysts filter out companies in each industry that are more sustainable than their competitors and rank them from ‘A’ for ESG pioneers to ‘F’ for ESG latecomers. The fund managers sift out the worst 25 percent of these companies and the securities that remain are eligible for DWS funds.

To help companies maintain or raise their sustainability rating and improve wherever possible, DWS itself takes an active role. Fund managers will address grievances by discussing them with management or at the annual general meeting, for example. To reflect the growing importance of ESG, DWS has employed a chief investment officer (CIO) for responsible investing since 2017. His remit is to optimize and further develop DWS’ sustainable investment strategy.

Sustainability throughout the investment universe

DWS now manages almost 30 billion Euros’ worth of assets that are invested in ESG-approved funds (mainly actively managed equity, bond and multi-asset funds).[2] While sustainable strategies generally have a positive impact on a company's share price (see Sustainable Investment - green strategy, black figures), securities that invest according to strict ESG criteria are not immune to temporary price losses. But with professionals taking care of business, investors can be confident that their money has been carefully placed using a well-thought-out ESG strategy.