Listed infrastructure funds may offer investors consistent income at relatively low volatility. Especially companies owning and operating infrastructure assets stand out, as they usually benefit from solid cashflows based on long-term leasing contracts.

In 2013, a German pope resigned and a new heir to the throne was born in England. Do you remember exactly what you were doing ten years ago? Which trains you travelled on? Which was the state-of-the-art mobile network generation? And do you remember how many wind turbines were already operating in the landscape?

Back then, DWS Invest Global Infrastructure was already an established equity fund. However, in November 2013, the two DWS fund managers Manoj Patel and Frank Greywitt decided to take a narrower approach to the asset class and shifted the focus of the fund to so-called "pure play" investments. Namely to those companies that own and operate infrastructure assets and are usually characterized by business models that provide relatively robust margins.

Many infrastructure companies are regulated monopolists – which allows them to benefit from solid cashflows, especially in the long term.

Infrastructure operators generate revenues even when the economy or consumer sentiment is weak.

Infrastructure: Solid cashflows despite economic cycles and inflation?

"Ten years ago, people were already talking about the distinct characteristics of infrastructure, but not yet about the advantage of the asset class to potentially compensate for inflation," recalls Manoj Patel, whose fund recently celebrated its tenth anniversary of “pure play”-focus with an attractive return of about 7 per cent per annum over the last decade.

“Pure play”-infrastructure, such as stocks of electricity, gas/water network or airport and toll road operators, are almost impervious to economic downturns and may hold up in phases of rising cost of living and prevailing inflation. That is because owners and operators of infrastructure usually benefit from an inelastic level of demand for the services they offer as those are essential for our everyday life. Likewise, those companies are able to generate solid cashflows even in difficult economic phases which often translates into attractive and relatively generous dividends payouts in the medium to long term.

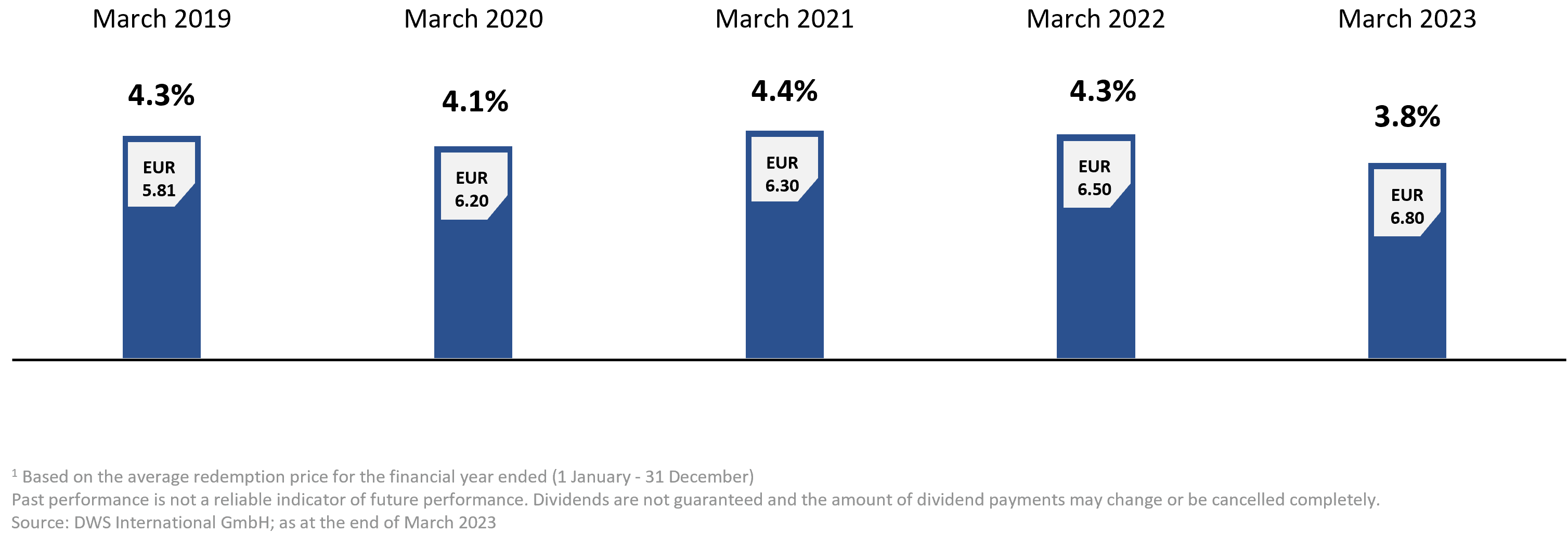

Dividends maintain a solid course

Attractive passive returns due to regular distributions (DWS Invest Global Infrastructure LD)[1].

Characteristics of tangible assets and tariff adjustments may counteract inflation

"Many companies in our fund, for example toll road operators, profit from underlying leasing contracts or concessions agreements which include annual inflation-linked pricing allowances. Therefore, inflation has hardly any negative impact on a company's revenue," explains Patel.

Even if an infrastructure company offers its services within a limited regulatory framework, for example as an electricity grid operator tied to tariff specifications, the company may pass on increased capital costs to its end customers. These costs may either be elevated through inflation or a rise in interest rates, as we have been experiencing recently, according to the fund manager. "In addition, we should keep in mind that infrastructure securities are always backed by investments in tangible real assets - airports, grid networks, mobile towers. Those assets do not lose value through inflation," says Patel, highlighting another argument for the asset class. According to him, about 80 per cent of DWS Invest Global Infrastructure’s investment universe may offer such potential for value preservation.[2]

"Pure play"-infrastructure may provide a high degree of diversification

"Ten years ago, the term infrastructure was very broad, some fund managers even accounted car manufacturers, such as Ford, to the infrastructure category. We decided to take a different approach and started to focus on "pure play": We select stocks with business models that generate at least 70 per cent of their revenues solely from owning or operating infrastructure assets. Consequently, we focus on businesses with high barriers to entry into their market - because this characteristic can also keep revenues stable over time," adds Patel's colleague Frank Greywitt. "In addition, these securities prove to be less volatile compared to other global sectors - especially in down markets. As infrastructure stocks usually have little overlap with other industrial or service sectors, this can significantly reduce the volatility of the fund," explains the fund manager.

Network operators for gas, electricity and data represent the backbone of the fundamental transformation of the economy.

The investment universe for the fund is steadily increasing

Another aspect that has changed since the two DWS managers re-focused the fund in 2013 is the geographical exposure. "Ten years ago, we were still in midst a low-interest rate cycle. Since then, many infrastructure companies have been bought by private equity firms that were able to refinance their investment at favorable terms and burden the companies with debt. This impacted the investment universe as well as the composition of the fund because many companies were either delisted or not listed at all," recalls Greywitt. Back in 2013, the DWS Invest Global Infrastructure had a much lower exposure to the US than it does today, favoring European, British, and Asian stocks. Even though the fund now has a strong regional focus to the US, it has not created any regulatory cluster risk. "This is because almost every US state has its own regulation, just as in Europe, where the infrastructure sectors are also regulated differently depending on the country. This creates an additional diversification effect, which can be advantageous," explains Frank Greywitt.

Around 70 per cent of the companies in DWS Invest Global Infrastructure currently are from North America. European companies make up around a quarter of the fund and the Asia-Pacific region around four per cent. "We are constantly adjusting the regional and sector weights depending on the expected performance of the individual stocks and their particular potential," according to Greywitt. "Additionally, some infrastructure providers, that had been acquired by private equity funds in the past, might return to the public market because of potential lower financing costs - which will expand the investment opportunities for our fund again," the manager expects.

Going forward, performance will more in focus again

One more thing has changed since the realignment to "pure play"-investments ten years ago: The dividend payout from equities has become relatively less attractive due to the sharp rise in interest rates over the last two years, while fixed-income investments now offer comparable returns. "Since 2013, investors have focused more on the dividend payout, in addition to the increase in value, than is now the case. In future, we believe that stock performance is likely to become more in focus again. At DWS, we have the expertise, the team and tools on board to make the right stock selection", says Greywitt, looking ahead to the next ten years of the fund.

His colleague Manoj Patel also believes the fund is well prepared for the two defining megatrends of our time - the digital and 'green' transformation of the economy. "DWS Invest Global Infrastructure has a high exposure to the energy sector, as it invests for example in electricity grid operators. Those companies own and operate the physical assets needed to foster the development of smart grid networks and, thus, contribute to the transformation of the energy segment. Owners of gas and oil pipelines should also have no difficulty in transporting 'green' hydrogen or biogas through their pipelines looking forward. Within the telecommunication sector, operators of mobile towers, as well as other transmission assets should be beneficiaries of the forthcoming digital economy." DWS Invest Global Infrastructure should therefore remain well positioned and be able to celebrate another successful decade of “pure play” infrastructure in 2033.

Risks[5]

- The performance of the sub-fund is predominantly determined by the following factors, which have both upside and downside potential:

- performance of international equity markets;

- company- and sector-specific developments;

- changes in the exchange rates of non-euro currencies against the euro.

- The sub-fund's investments may focus on different sub-sectors, countries and market segments for a given variable period.

- In addition, derivatives may be used. These investments are also associated with further opportunities and risks.

- Stronger regulation in the infrastructure sector worldwide.

- Weakening of underlying trends (urbanization / mobile data usage / higher transport demand of people and goods or energy).

- Concentration risk: Due to the focus on equities in the infrastructure sector, diversification within the fund is limited.

- The share value may at any time fall below the purchase price at which the customer acquired the unit.