- Home »

- Inform »

- Markets »

- Market outlook »

- Market outlook - April 2024

to read

Moderate price potential for equities – high concentration in portfolios entails risks

#1 Market & Macro

- In the first quarter of 2024 equities clearly turned out to be the top yield earners. Several stock market indices hit new all-time highs. The reasons are obvious: “Global economic data have been in surprisingly good shape recently. An additional factor is the unharnessed optimism around Artificial Intelligence,” Björn Jesch, Global CIO, states.

- Bonds have not been able to keep up with this pace during the last three months. Uncertainty about the further path of inflation, whether it will continue to recede and do so quickly, in combination with surprisingly robust U.S. economic growth have boosted yields again so that prices have fallen. “For the majority of stock markets we have witnessed inflated valuations, i.e. higher price/earnings ratios. Price gains were thus mostly driven by declining risk premiums,” Jesch adds.

- No acceleration is to be expected with a view to corporate earnings in the next twelve months. The dynamics in earnings growth should be highest in Emerging Markets and in Japan. There are currently no signs of an end to the positive momentum driving prices of mega caps. This is, however, not only good news since it has led to dangerously high concentrations in active and passive portfolios and to a very high correlation within many equity portfolios.

- Main losers of this trend are small- to mid-caps which do not prosper in such an environment. Jesch adds: “Although we are still constructive on European small- to mid-caps, we have downgraded them from “strong outperform” to “outperform”. Jesch summarizes: “Against the background of their very good run up to now, our forecast for most stock markets are rather modest total returns of roughly five percent by March 2025.”

Topics driving capital markets

Economy: India as the growth champion – United States holding up well

- Even if growth is slightly falling in the United States, the U.S. economy is surprisingly resilient: employment is still increasing, consumers continue to spend money though not quite as much as in the past. Our growth forecast for the current year is 1.8 percent.

- Eurozone growth might, however, turn in considerably lower at 0.7 percent in 2024.

- India should be the growth champion of this year – with gross domestic product rising by 6.8 percent, two percentage points more than China’s GDP (4.8 percent).

Inflation: generally falling but still very high in the services sector

- Inflation rates are falling both in the United States and in the Eurozone. Eurozone core inflation, excluding the generally more volatile prices of energy and food, was at 2.9 percent in March (February: 3.1 percent). However, prices in the services sector, which are strongly driven by wage growth, continue to rise fast at 4.0 percent.

- In Germany, the inflation rate has declined to 2.2 percent in March (after 2.5% in February). Still high price rises in the services sector are also striking here – 3.7 percent in March after 3.4 percent in February.

Central banks: rate cuts expected in the United States and in the Eurozone – Japan might rather hike

- What seems to be clear is that the U.S. Federal Reserve (Fed) and the European Central Bank (ECB) will start to cut rates this year. It is, however, no longer that clear how many rate cuts will be made.

- The Japanese central bank (BoJ) is an outlier here – it will probably raise interest rates to 0.25 percent by March 2025. After 17 years, the BoJ ended its period of negative rates in March, by raising its short-term interest rates to 0.1 percent.

Risks: down-side surprises from interest rates, geopolitics and consumption

- We currently see three downside risks for the Eurozone: first, a delayed acceleration of private consumption. Second, a weaker global demand, and third, a further escalation of geopolitical crises.

- In the United States, one risk is that interest rates stay higher than expected over a longer period of time. One reason might be economic dynamics making inflation stickier than up to now assumed by the markets.

First bright spots for value stocks

#2 Equites

- Growth stocks versus value stocks – this has been an unfair battle in the last 18 years. Except for 2022, growth stocks have always taken the lead, and generally very clearly so. Currently, there seems to be a silver lining for investors in value stocks, i.e. corporations with generally low price-to-book ratios, comparably high dividend yields and a low price/earnings ratio.

- “In the past few weeks, we have witnessed a relative recovery of value stocks, particularly since big tech stocks could not keep up their momentum,” portfolio manager Jarrid Klug explains. The reasons: economic data beating expectations recently and the resulting lower probability of a recession. However, Klug does not expect the predominance of growth stocks being now a matter of the past.

- “This year up to now, performance on the global stock market has again been dominated by corporations linked to a strong position in the mega trend topic of Artificial Intelligence,” Klug states. But a permanently strong U.S. economy could contribute to a better performance of value stocks, particularly since the valuation discount of value stocks versus the market continues to be very high. “Moreover, high valuation differences on the market tend to be a good stock-picking environment for value stocks, i.e. the clever selection of the most promising individual papers,” Klug continues.

- Recently, there have been more positive news from classic value sectors such as the financial, health, industrial and energy sectors. Should rates be cut less than currently expected, this could have a positive effect on the profit situation of European banks, which are additionally valued very cheaply.

- Even in the auto sector, which is often viewed critically, profits do not seem to have slumped as drastically as implied by low valuations. In the badly battered chemical sector, there are first signs of improving new orders, and in U.S construction, activities are picking up speed, amid still high interest rates.

- As to regions, Klug prefers European value stocks versus their U.S. counterparts, since, on average, the latter continue to be rather expensive. However, European companies must manage to boost their earnings growth in order to attract more attention from investors.

Value stocks in low demand in the last few years

Relative performance of value versus growth stocks

Source: DWS Investment GmbH, as of March 2024

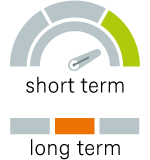

Equities USA

More downside risk short-term

|

|

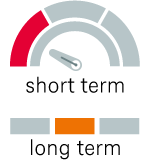

Equities Germany

Poor price potential at the current high price level

|

|

|

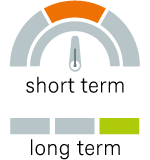

Equities Europe

Gap between the earning growth of European and U.S. corporations should narrow

|

|

|

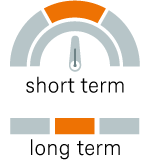

Equities Emerging Markets

India currently more promising than China

|

|

|

Potentially good yield opportunities with short sovereign bonds

#3 Fixed Income

- After a good fourth quarter of 2023, the first three months of 2024 have been rather mixed for investors. “The reasons are primarily an improved economic environment in the United States and inflation rates above the target of many central banks. Due to these two factors, the rate cuts expected by the market for 2024 were partly “priced out” again, and yields started to climb again,” Oliver Eichmann, Head of Fixed Income EMEA, states. However, the outlook for the nine months to come is still rather positive.

- “I expect sovereign bond yields with shorter and medium maturity to fall and prices to rise, due to declining central bank rates around the middle of 2024 in the Eurozone and in the United States. Moreover, returns in most segments are rather interesting. For example, the return of a typical index for shorter euro sovereign bonds, the ICE BofA 1-3 Year Euro Government Index, is slightly above three percent.

- “Based on our main scenario, we expect very interesting total returns for shorter U.S. sovereign bonds,” Eichmann states. However, euro investors should bear in mind that dollar investments carry some currency risk for them. “Over twelve months, we expect positive total returns for 2-year sovereign bonds in the Eurozone,” the fixed-income expert continues.

Sovereign bond yields have risen again

Development of 10-year yields

Source: DWS Investment GmbH, as of March 2024

U.S. government bonds (10 years)

Yields expected to fall slightly

|

|

German government bonds (10 years)

Little potential for price gains

|

|

Emerging market sovereign bonds

Good prospects continued

|

|

Credit

Investment Grade

|

|

High Yield

|

|

Euro/Dollar: stronger economy and higher yields should support the dollar

#4 Currencies

|

|

|

Gold: substantial price gains – prices are supported by several factors

#5 Alternative assets

|

|

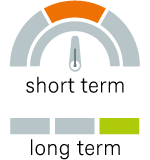

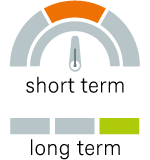

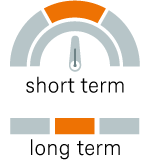

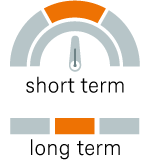

LegendThe strategic view by March 2025 The indicators signal whether DWS expects the asset class in question to develop upwards, sideways or downwards. They indicate both the short-term and the long-term expected earnings potential for investors. Source: DWS Investment GmbH; CIO Office, as of 09 April 2024 |

|

|

|

|

|

|

|