| DWS ESG Assessment methodology / exclusion criteria | Assessment[1] or revenue threshold[2] |

|

| DWS Group policies | DWS Coal Policy (coal mining and power generation from coal ≥ 25% revenue; coal expansion plans)[3] |

Non-compliant |

| DWS Controversial Weapons Policy (cluster munition, anti-personnel mines, biological and chemical weapons)[4] |

Non-compliant |

|

| Controversial sectors (excl. climate) | Other controversial weapons (depleted uranium weapons, nuclear weapons, incendiary bombs containing white phosphorus)[4] |

No involvement |

| Manufacturing of products and/or provision of services in the defence industry |

≥ 5% |

|

| Manufacturing and/or distribution of civil handguns or ammunition |

≥ 5% |

|

| Manufacturing of palm oil |

≥ 5% |

|

| Manufacturing of tobacco products |

≥ 5% |

|

| Manufacturing of adult entertainment |

≥ 5% |

|

| Manufacturing of products in and/or provision of services for the gambling industry |

≥ 5% |

|

| Nuclear power generation and/or uranium mining and/or uranium enrichment |

≥ 5% |

|

| Climate-related assessments | Coal mining[3] | ≥ 1% |

| Power generation from coal[3] | ≥ 10% | |

| Extraction of crude oil | ≥ 10% | |

| Unconventional extraction of crude oil and/or natural gas (including oil sand, oil shale/shale gas, Arctic drilling) | > 0% | |

| Mining and exploration of and services in connection with oil sand and oil shale | ≥ 10% | |

| Coal mining and oil extraction | ≥ 10% | |

| Power generation from and other use of fossil fuels (excluding natural gas) | ≥ 10% | |

| DWS Climate and Transition Risk Assessment (corporates & sovereigns) | No F | |

| General ESG assessments | DWS ESG Quality Assessment (corporates & sovereigns) |

No F |

| Freedom House Status (sovereigns) |

No "Not free" |

|

| UN Global Compact Assessment (corporates) |

No "Fail" |

|

| Regulatory metrics | Good Governance Assessment measured by DWS Norm Assessment (corporates) |

No F / M |

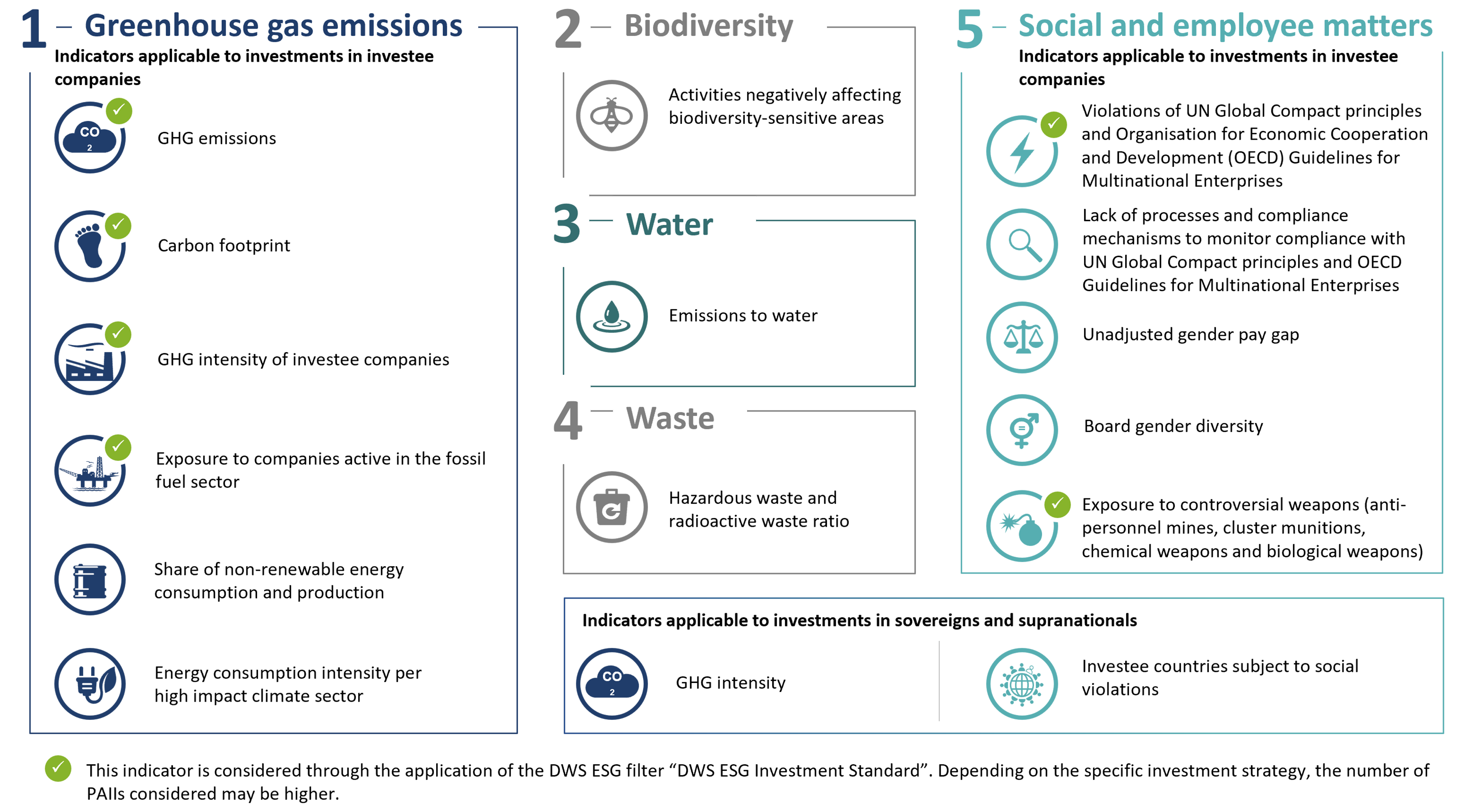

| Principal adverse impact indicators (PAII)[5] |

PAII #1 / #2 / #3 / #4 / #10 / #14 / #16[6] |

|

| Share of sustainable investments (SFDR)[7] |

Individual per fund |

|

| Share of sustainable investments (EU Taxonomy)[8] |

0% |

Sustainable Investments - ESG criteria complement the classic investment objectives

Sustainability criteria can complement the investment objectives of return, risk and liquidity, with environmental, social and governance-related aspects. The three sustainability criteria provide orientation. They can be understood as a guidance to sustainable investing.

The DWS ESG Engine - How we create robust ESG assessments

1. The ESG Methodology Council (EMC) is co-chaired by the head of CIO for Responsible Investments and the head of ESG Advisory and ESG Product Methodology. The EMC meets weekly to discuss the implementation of the assessment methodologies in the ESG Engine, among others.

2. The Sustainability Assessment Validation Council (SAVC), chaired by the Global Head of Research, consists of ESG specialists from DWS’s research department and reviews ESG Engine assessments before they become effective. The council applies corrective adjustments in case a result is found materially incorrect, especially as a result of current insights gained from engagements and company disclosure reviews.

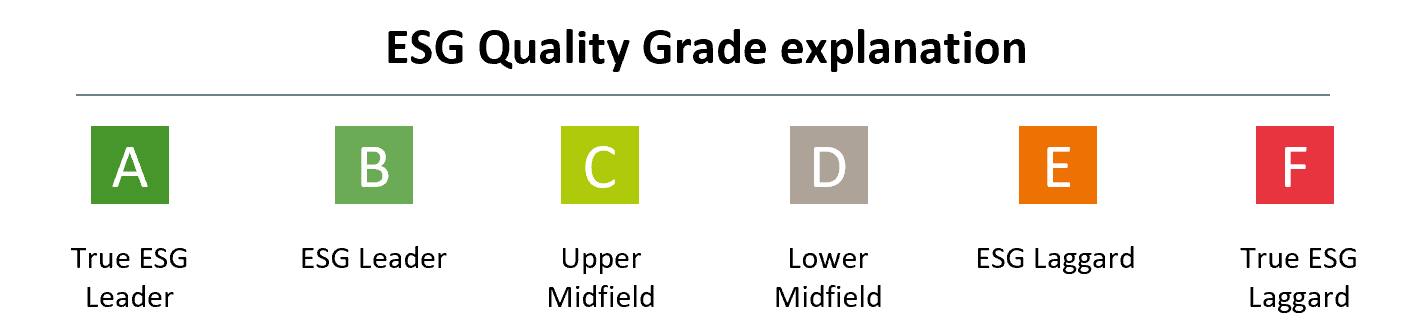

1. The ESG database derives “A” to “F” letter coded assessments within different categories. Within each category, issuers receive one of six possible scores, with "A" being the highest score and "F" being the lowest score. If an issuer’s score in one category is not considered eligible, the portfolio management is prohibited from investing in that issuer, even if it is eligible according to the other categories. For exclusion purposes, each letter score is considered individually and may result in exclusion of an issuer.

2. Shown is the %-revenue threshold which, when it is greater or equal to, triggers an exclusion. The focus is usually on manufacturing or production, for example, in the case of oil sands, the extraction of oil.

3. The filter excludes companies with coal expansion plans, such as additional coal extraction, production or use, based on an internal identification methodology. The aforementioned coal-related exclusions refer exclusively to so-called thermal coal, i.e., coal used in power plants for power generation.

4. DWS Controversial Weapons Policy (DWS CW Policy) predominantly covers Controversial Conventional Weapons (CCW). Other controversial weapons (CW) do not constitute controversial conventional weapons in the sense of this policy, however DWS deems these weapons controversial and excludes manufacturers with a nexus to those weapons from financial products applying certain ESG Filters. Controversial weapons in DWS ESG Investment Standard filter include CCW (cluster munition, anti-personnel mines as well as biological and chemical weapons), as well as depleted uranium weapons and nuclear weapons, and incendiary bombs containing white phosphorus. Controversial weapons are any ownership interest, regardless of revenue. An ownership is identified as a weapons manufacturer (F), component manufacturer (E) or a relevant ownership structure with an "E" or "F" graded company (D). With respect to white phosphorus, those issuers identified as manufacturers or producers of essential components of incendiary bombs based on white phosphorus are excluded.

5. Depending on the asset class of the fund and its product strategy, actively managed funds reporting under Article 8 or 9 SFDR can consider different PAIIs. For example, PAII 16 is only taken into account by funds investing in sovereign issuers.

6. )Investee countries subject to social violations (no. 16).

7. Share of sustainable investments according to SFDR Art. 2(17): The methodology for determining the share of sustainable investments follows four steps. In order to identify sustainable investments, the first step is to examine whether a company has a positive contribution to the UN SDGs through its business activities. The measurement of business activities is usually based on a company's revenues, partly also based on a company's capital expenses (capex) or operating expenses (opex). The second step is to proof that the company does not have a negative impact on any social or environmental objective when carrying out its business activities (DNSH assessment). If this is the case, the third step is to examine whether the company meets principles of good governance: It will exemplarily be considered whether the company has the worst norm assessment (so-called "minimum safeguards"). One example is the fight against corruption. If this is also the case, the positive contribution of the company identified in the first step can ultimately be taken into account. Thus, the company's share of sustainable investments would contribute to the share of sustainable investments in the portfolio.

8. Share of sustainable investments according to EU Taxonomy: The EU taxonomy aims to provide clarity on which economic activities are to be considered environmentally sustainable. For this purpose, a list of criteria for companies is used to define which economic activities or revenues contribute to the one of the six EU environmental goals. Due to a lack of data availability, DWS currently does not set a minimum percentage for ecologically sustainable investments according to EU Taxonomy in its actively managed funds.