- Home »

- Inform »

- Markets »

- Market outlook »

- Market outlook - January 2024

to read

“Investors should not chase the market”

#1 Market & Macro

- At the end of November 2023, our forecasts for 2024 were based on the assumption that the major stock markets had a high one-digit price potential by the end of the year. Due to rapid price rises still in December 2023, these price targets were already achieved or even surpassed at the beginning of 2024. Time to revise our forecasts upwards? “Currently, we do not see any reason to set our price targets higher,” Björn Jesch, Global CIO, states. “This would only be justified if either ten-year Treasury yields fell significantly short of our expectations of 4.2% by year-end or corporate profits came in much better than forecast by us in November. Currently, there are no signs of either.” Jesch characterizes markets as somewhat easy-going at the moment. The VIX, the S&P 500 volatility index, has meanwhile arrived at an extremely low level of 12. This indicates a rather low risk awareness of investors. “Tactical stock investors should find better entry points in the course of this year”, this is what Jesch, who is not fond of “chasing” the market, expects. Risk premiums in Europe – and particularly for small- to mid-caps – and in Japan are not as high. For this reason, Jesch prefers these two regions for equity investments over the United States.

52 percent

of the energy consumed in Germany was generated by renewable energies in 2023. But it’s still a long way to go. This share is set to rise to 80 percent by 2030. [1]

Topics driving capital markets

Economy: Industrial nations falter, China should bottom out

-

The U.S. economy is expected to remain sluggish during 2024, before accelerating again in 2025. The unstable geopolitical situation and the risk of further escalation are significant drags on growth.

-

Economic growth in the Eurozone is also expected to be rather moderate in 2024. However, China seems to be bottoming out, and other emerging markets are set to benefit from this development.

Inflation: too early to call it a day

-

The danger of rising inflation has not been averted yet. In Germany, the inflation rate amounted to 3.7% in December (after 3.2% in November). Higher energy prices – driven by higher carbon prices – and still rising labor costs could push inflation towards four percent in January.

-

Eurozone inflation has risen to 2.9% in December (November: 2.4%). Particularly in the services sector, the trend towards higher prices continues – plus four percent in December.

Central banks: rate cuts might take a while longer than markets expect

-

The price rally in December was mainly driven by the expectation traded on the markets that interest rates would be cut soon. There are, however, more and more signs that this expectation was premature.

-

The development of the labor market will play a pivotal role – keyword: wage inflation. An unwinding of the tight job market situation is not indicated by the most recent U.S. data. More jobs have been created, and wages have increased by 4.1% year-on-year. The U.S. Federal Reserve will probably not be in a hurry to cut rates.

Substantial catch-up potential for European small- to mid-caps

#2 Equites

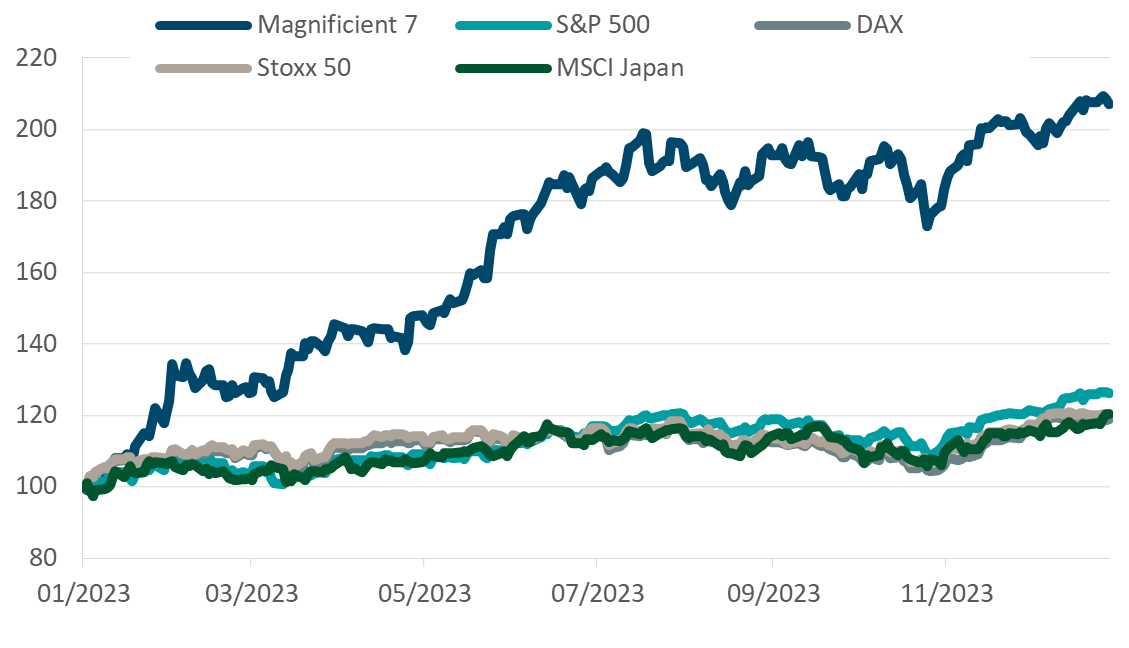

- The past year brought much joy to equity investors. Despite the various political troublespots – Russia’s ongoing war against Ukraine, the conflict in the Middle East – , almost all major indices were riding high. U.S. tech stocks were among the top performers. The Nasdaq Composite registered annual gains of 33 percent. Japanese stocks finished the year 29 percent higher. The S&P 500 rocketed by roughly 26 percent, driven by exploding prices of the “magnificent seven” – the largest companies in the S&P 500 –, which, by the way, had lost almost half of their value in 2022. Eurozone equities also had a very good run: the EuroStoxx 50 was up roughly 23 percent. The downside of this development: prices have already gained so much that, almost across the board, we currently see only little upside potential.

- European second-tier stocks are among the few exceptions: their performance has clearly lagged behind blue chips over the past two years. “Small- to mid-caps are valued at their cheapest level in 15 years,” Philipp Schweneke, Co-head European Equities, states. Market participants tend to punish these stocks in times of higher inflation rates. One of the reasons is their assumption that due to higher debt, small caps are more vulnerable in these constellations. But this is a myth. Schweneke: “In Europe, small- to mid-caps are in fact less indebted than blue chips. Even with a view to expected earnings growth for 2024 and 2025, small and mid-caps clearly outdo large caps.” Currently, there is a whole range of extremely interesting stocks with robust growth and moderate valuations.

668 billion

kilowatt hours the electricity to be supplied by wind and solar in the United States in 2024. Electricity generated from solar and wind systems will thus surpass power produced by burning coal for the first time. [2]

Magnificent Seven” the big winners once again

Performance of major stock markets in the past twelve months

Source: DWS Investment GmbH, as of end of December 2023. Past performance is not indicative of future results.

Equities USA

Hardly any impetus expected for U.S. equities

|

|

|

Equities Germany

Very good investment year of 2023 limits opportunities in the current year

|

|

|

Equities Europe

Prices have already had a good run

|

|

|

Equities Emerging Markets

Selection remains key

|

|

|

Markets might currently be overoptimistic with a view to rate cuts

#3 Fixed Income

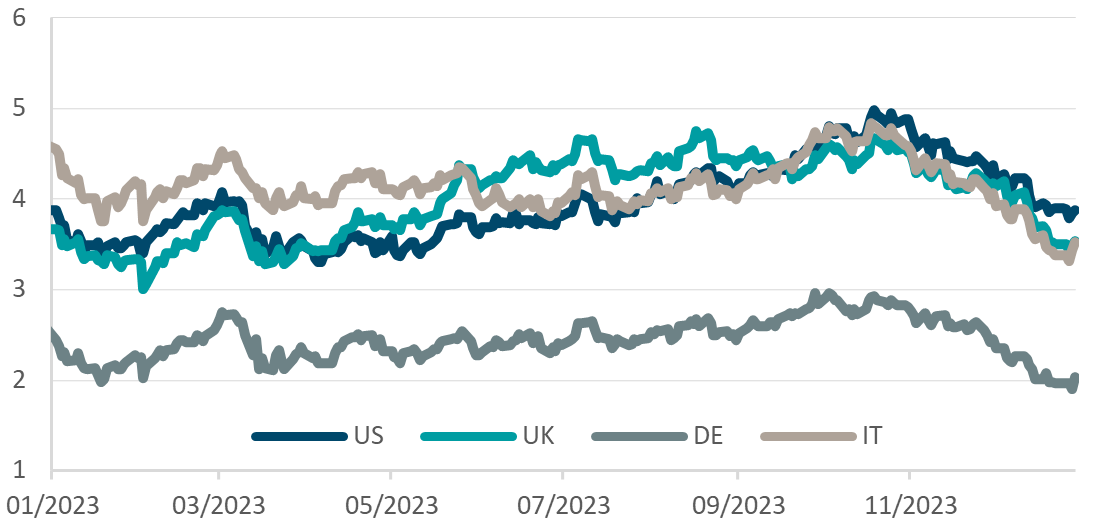

- Material current yields were the game changer of 2023 for bonds. Two-year Treasuries temporarily yielded five percent, U.S. high yield bonds ten percent. Towards the end of 2023, yields fell quite abruptly. Oliver Eichmann, Head of Rates Fixed Income EMEA, states the following reasons: firstly, inflation data in the United States and in Europe turned out to be lower than many market participants had expected. Secondly, central banks such as the U.S. Federal Reserve and the European Central Bank (ECB) signalled that the hiking cycle could come to an end.

- “I think that the optimism discounted with a view to rate cuts was too high on the bond markets – temporarily, 1.5 percent had been priced in for the ECB by the end of 2024. Our expectations are key interest rate cuts by 0.75 percent by the end of this year,” Eichmann states. Markets might therefore make some downward corrections in the next few weeks. In the short term, he also cautions investors with a view to high-yield bonds. Recently, yield spreads over sovereign bonds have narrowed somewhat too excessively and might widen again

Sovereign bonds – yield highs are over

Development of ten-year sovereign bond yields since the beginning of 2023

Source: DWS Investment GmbH, as of end of December 2023

U.S. government bonds (10 years)

Yield decline seems to be stopped

|

|

German government bonds (10 years)

Bunds less attractive than U.S. Treasuries

|

|

Emerging market sovereign bonds

Yield advantage over bonds from industrial nations

|

|

Credit

Investment Grade

|

|

High Yield

|

|

Little further revaluation potential left for the euro

#4 Currencies

|

|

|

Gold price could continue to rise

#5 Alternative assets

|

|

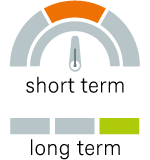

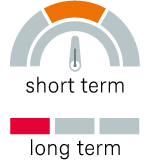

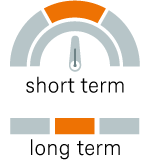

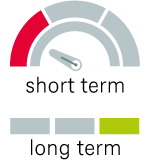

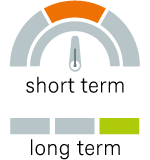

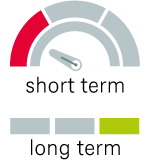

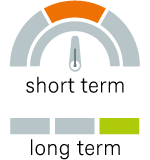

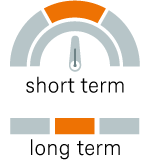

LegendThe strategic view by December 2024 The indicators signal whether DWS expects the asset class in question to develop upwards, sideways or downwards. They indicate both the short-term and the long-term expected earnings potential for investors. Source: DWS Investment GmbH; CIO Office, as of 10 January 2024 |

|

|

|

|

|

|

|