The DWS approach to the selection of comparable fundamental values

The CROCI (Cash Return on Capital Invested) investment strategies turned twenty years old this year. The first strategies were launched in June 2004, shortly after the dot-com bubble and before the Global Financial Crisis. Since then, there have been various different economic environments and the strategies have significantly outperformed both broad and value-specific benchmarks over the long term. Currently, there are eight investment strategies, including regional, global, revenue, and thematic approaches, mostly focusing on valuation.

CROCI was created in 1996 as a proprietary valuation approach and remains DWS's own valuation approach for analysing companies globally. It sets out to allow a meaningful comparison of valuation and other metrics across different sectors and countries. Identifying the most attractive companies in terms of fundamental economic valuation is not straightforward, as the pro forma data in the annual financial statements do not always reflect the true economic situation of the companies. Accounting standards allow a wide margin of manoeuvre in the treatment of assets and liabilities, which makes direct comparison between companies difficult.

The CROCI approach seeks to identify relevant data that is easily comparable across companies, providing a solid foundation for fundamental equity investing. To achieve this, CROCI uses proprietary research developed and maintained by a team of more than 45 investment professionals. These experts conduct consistent and comparable bottom-up due diligence on more than 900 companies globally, ensuring valuations are accurate, comparable and useful to investors.

Discover our full range of CROCI funds

How do we obtain economically comparable data?

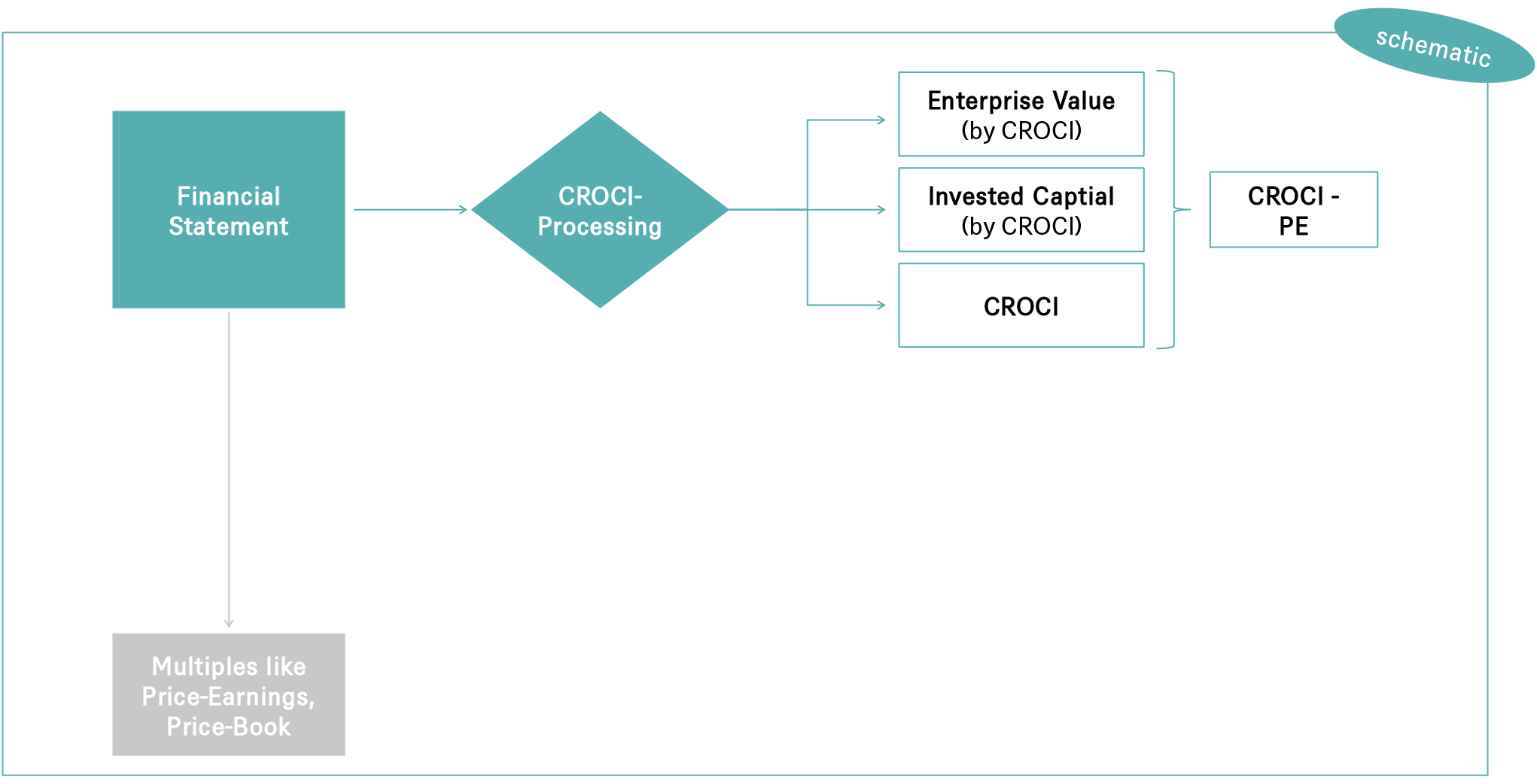

The value-oriented CROCI approach values companies according to a standardised methodology, making it much easier to compare the valuations of different companies.

CROCI stands for Cash Return On Capital Invested and is the "economic" equivalent of the return on capital employed. CROCI is the core return metric of the approach.

The balance sheets of companies are thoroughly analysed by CROCI company analysts in a standardised fashion. It is a labour-intensive process; introducing a new company can take a month or more of work and each company is usually updated at least six times a year. Up to 250 line items per company are analysed in each financial year. This is needed to make the company's data easily comparable to that of other companies, including those in other industries and countries, and to determine the various key metrics (such as the CROCI). Together with our definitions of company value and capital employed, they form the economic P/E ratio, CROCI's key valuation metric.

What distinguishes the CROCI from other ratios?

Unlike many conventional valuation methods, the CROCI approach includes any asset that generates cash flow, regardless of whether it is included in the pro forma accounts. Only by understanding a company's true balance sheet can its business model be made comparable.

Why CROCI?

Historically, CROCI has been able to generate alpha during the cycle in the order of 3-4% per year over almost 20 years of history* (*past performance is not indicative of future performance)

CROCI can provide investors with core exposure to developed markets and sub-regions, or provide a satellite approach, such as with its unique sector rotation approach.

CROCI offers consistent exposure to economic value, which has historically provided a solid upside capture in normal markets along with good downside capture, particularly in distressed markets.

CROCI strategies tend to have higher Sharpe Ratios than conventional value strategies, as company-level due diligence helps keep the volatility of the strategies generally in line with the broader market.

CROCI portfolios tend to give exposure to higher quality companies, so they are well suited for performance throughout the investment cycle.

CROCI Strategies: How Are DWS Client Funds Invested?

The funds are invested in companies with the most favourable valuations according to the CROCI methodology. In addition to the provisions of Article 8 of the EU Taxonomy Regulation, other ancillary conditions are taken into account, for example, for good diversification or sufficient liquidity of the securities being traded. As a general rule, the securities in the portfolio are equally weighted. Portfolios are reviewed quarterly and adjusted if necessary. At the same time, also quarterly, the fund's weightings are rebalanced.

The value-oriented and fundamental CROCI approach was developed in 1996 for the analysis of companies

Nearly 50 analysts systematically evaluate around 900 companies globally using this approach. The DWS approach can often differ significantly from classic value strategies. In particular, CROCI funds tend to be exposed to higher quality companies.