Equity-like returns with reduced volatility require high flexibility and disciplined risk management

Flexible in all directions |

Appropriate risk control |

|

The DWS Invest ESG Dynamic Opportunities is as flexible anddiverse as a multi-tool. The fund can invest in equities, bonds, currencies and gold, and using direct investments in equities or funds or derivatives. There is also full flexibility with regard to segments, regions or company sizes. By cleverly combining the tools, it is possible to achieve equity-like returns with a balanced mutual fund. |

A specially developed risk model is an integral part of the investment process. In comparatively unsettled stock market phases, the risk appetite is turned down and thus risk reduced. If there are fewer ups and downs on the stock market, more opportunities can be seized. This can result in an asymmetrical risk-reward profile with equity-like returns and reduced fluctuations. |

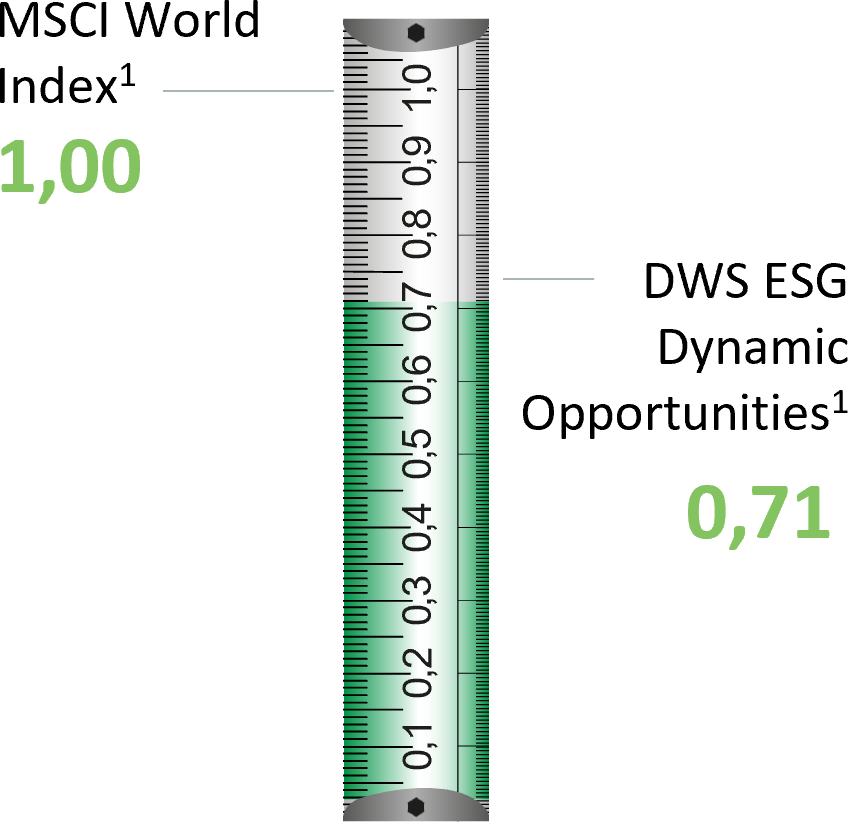

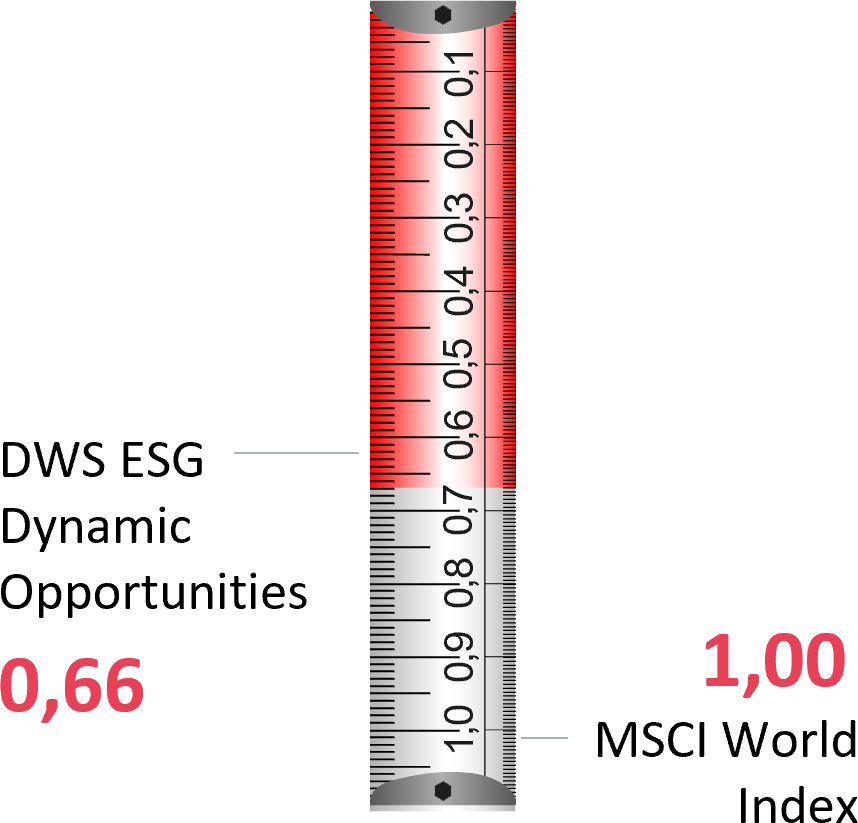

The asymmetrical risk-reward profile[1] of DWS Invest ESG Dynamic Opportunities

In rising markets

In falling markets

Period: 01.01.2013 (start of implementation of the strategy) to 30.09.2023, calculation based on monthly data.

There is a rule on the stock market saying: more opportunity, more risk. If this ratio of return opportunity and risk of loss does not apply, there is an asymmetrical risk-return profile. In relation to the DWS Invest ESG Dynamic Opportunities, this means that while the DWS Invest ESG Dynamic Opportunities was able to record 71 percent of the price gains in rising markets, the fund only suffered 66 percent of the losses in falling markets.[2]

Sustainable Investments - ESG criteria complement the classic investment objectives

Sustainability criteria can complement the investment objectives of return, risk and liquidity, with environmental, social and governance-related aspects. The three sustainability criteria provide orientation. They can be understood as a guidance to sustainable investing.

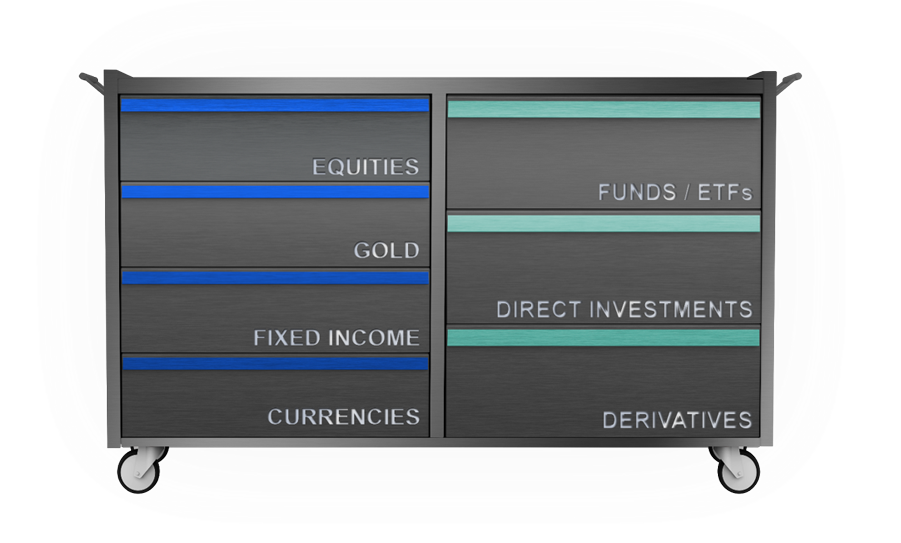

A look into the multi asset kitchen

Investing can be like cooking. You have to choose the right ingredients.

The tools of DWS Invest ESG Dynamic Opportunities

Fund details of DWS Invest ESG Dynamic Opportunities LC

|

Shareclass |

LC |

|

Currency |

EUR |

|

ISIN |

LU1868537090 |

|

Valor |

43448420 |

|

Front-end Load |

up to 4.0% |

|

All-in fee |

1.300% p.a. |

|

Current costs (Status: 31.12.2022) |

1.550% |

|

Earnings |

Accumulation |

Supplementary information on the investment policy

The investment policy is defined, among other things, by environmental and social aspects, as well as the principles of good corporate governance. The fund management applies DWS‘s own ESG filter „DWS ESG Investment Standard“ when selecting assets. At least 75% of the fund’s assets are invested in assets covered by the DWS ESG Investment Standard.

Share of sustainable investments according to SFDR

If a company has a positive contribution to at least one of the United Nations SDGs through its economic activity and does not violate any other goal, as well as adheres to principles of good governance, it is considered a sustainable investment.

| Minimum share of sustainable investments[4] | 15%[5] |

Risks[6]

-

At any time, the price of the shares can fall below the price at which the investor acquired them (up to the risk of total loss).

-

Market, industry and company-specific price fluctuations on the equity markets.

-

Interest rate, price and currency fluctuations in the bond markets. A creditworthiness risk exists with regard to the issuers of bonds. In general terms, this is the risk of over-indebtedness or insolvency, i.e. the potential temporary or permanent inability to fulfill interest and/or repayment obligations on schedule. This can have a negative impact on the fund's performance.

-

Asset-backed securities may be less liquid than corporate debt; in addition, there is the risk of early repayment, which can lead to fluctuations in the unit price.

-

The use of derivatives involves counterparty risks, i.e. the creditworthiness risk of the counterparties (see the above risk notice on creditworthiness risk). Derivatives are subject neither to statutory nor voluntary deposit insurance.

-

The fund has the option of achieving leverage through the use of derivatives. The use of leverage can result in the increase in potential losses.

-

The fund can invest in assets with different currencies. This gives rise to exchange rate risks, which may be hedged.

More topics

1. The risk-reward profile describes the relationship between the potential return of a security and the risk of loss. If these two aspects are unequally distributed, i.e. one profile outweighs the other, this is referred to as an asymmetrical risk-reward profile. The MSCI World is a stock index that reflects the performance of around 1,600 stocks from 23 industrialised countries. No assurance can be given that the investment objectives set out in the prospectus will be achieved. Forecasts are based on assumptions, estimates, views and hypothetical models or analyses that may prove to be inaccurate or incorrect.

2. No assurance can be given that the investment targets set in prospect will be achieved. Forecasts are based on assumptions, estimates, opinions and hypothetical models or analyses that may prove to be inaccurate or incorrect. Asset allocation is subject to change at any time without notice. Past performance is not a reliable indicator of future performance.

3. In the narrower sense, a derivative is a financial instrument whose price depends on other reference variables such as indices, shares or bonds. No assurance can be given that the investment targets set in prospect will be achieved. Forecasts are based on assumptions, estimates, opinions and hypothetical models or analyses that may prove to be inaccurate or incorrect. Asset allocation is subject to change at any time without notice. Past performance is not a reliable indicator of future performance.

4. The proportion of sustainable investments as defined in Article 2(17) SFDR in the portfolio is calculated in proportion to the economic activities of the issuers that qualify as sustainable.

5. These are minimum shares that do not necessarily add up to the total share.

Various asset classes are available to the fund management: Equities, gold, bonds or currencies. In addition, it can be flexibly decided to invest directly in shares, in funds or ETFs or in derivatives

Various asset classes are available to the fund management: Equities, gold, bonds or currencies. In addition, it can be flexibly decided to invest directly in shares, in funds or ETFs or in derivatives