Our society is built on a functioning infrastructure

It connects us, for example, through motorways, electricity grids and railway tracks, provides, among other things, running water in the home and electricity from the socket, and enables telephone calls worldwide and access to the internet around the clock.

The biggest infrastructure drivers at a glance

Railways, fiber optic networks, mobile phone masts - the demand for infrastructure is growing worldwide.

Investing in global infrastructure

Infrastructure moves people globally and governments are investing heavily into this are. What do investors need to know?

Why operators benefit from infrastructure

Infrastructure projects are usually planned for several years, if not decades. The long terms, combined with fixed contracts, ensure a relatively stable and predictable cash flow for infrastructure operators. The DWS Invest Global Infrastructure LC invests in the stocks of these companies.

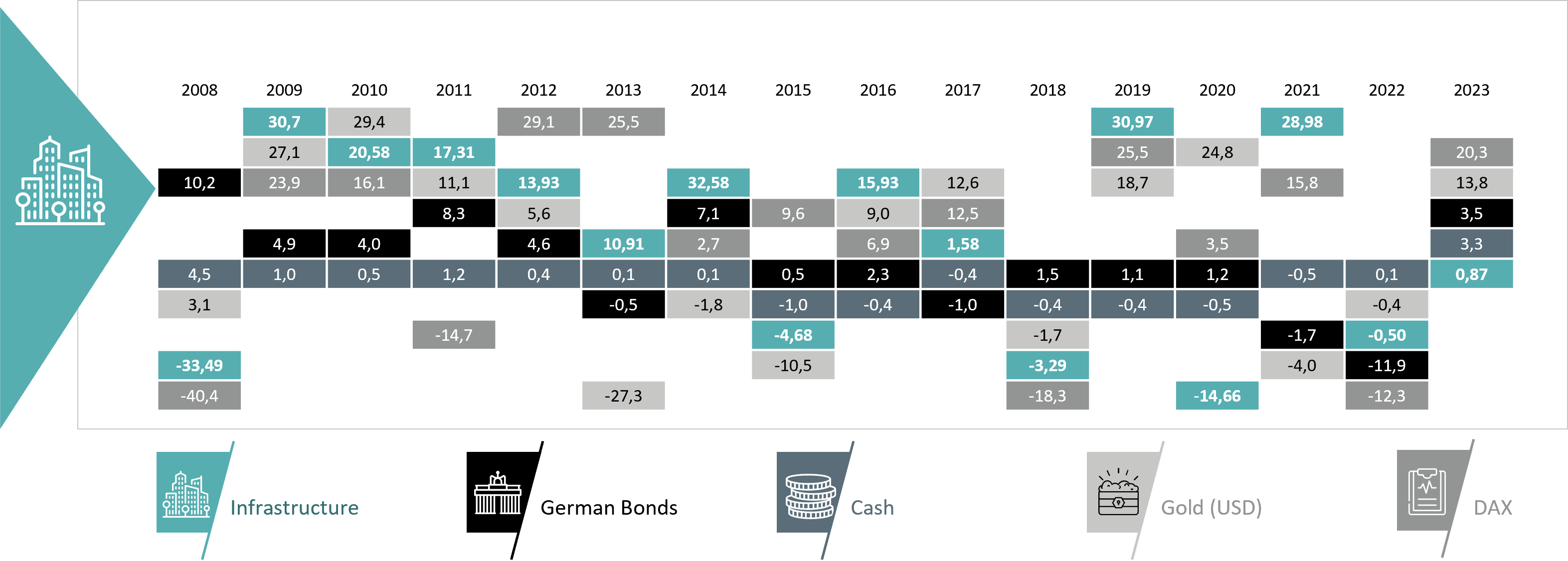

Potential benefits of Infrastructure Securities

Arguments for the infrastructure

Fund details of DWS Invest Global Infrastructure LC

|

Shareclass |

LC |

|

Currency |

EUR |

|

ISIN |

LU0329760770 |

|

Valor |

3730857 |

|

Front-end Load[1] |

5,0% |

|

Management Fee |

1,500% |

|

Current costs (Status: 31.12.2020) |

1,610% |

|

Plus performance-related fee (current fiscal year) |

N/A |

|

Earnings |

Accumulation |

Risks[2]

-

Market, sector and company-related share price losses.

-

Exchange rate losses.

-

Stronger regulation in the area of infrastructure worldwide.

-

Weakening of underlying trends (urbanisation/mobile data use/increased demand for transport of people and goods or energy).

-

Concentration risk: By concentrating on shares in the infrastructure sector, there is limited diversification within the fund.

-

Due to its composition/the techniques used by the fund management, the investment fund has a significantly increased volatility, i.e. the unit prices may be subject to considerable downward or upward fluctuations even within short periods of time.

-

The unit value may at any time fall below the purchase price at which the client acquired the unit.